NACM National Trade Credit Report (NTCR)

Domestic Credit Report Solutions

Dun & Bradstreet Data Cloud offers the world’s largest set of business decisioning data and analytical insights, providing insights on hundreds of millions of businesses and other commercial entities across the globe. We source data from 10’s of thousands of sources, 10’s of millions of websites, and crowd-sourcing/validating initiatives. We continuously monitor our vast number of sources for changes that impact information in the Dun & Bradstreet Data Cloud, verify changes, and update the Data Cloud accordingly.

Additionally, the Data Cloud offers the deepest and richest insights into relationships of all types among companies, identifying millions of relationships that can inform decision making. We leverage information from our global sources, along with proprietary capabilities, to discover and curate millions of business to business relationships. These relationships can include corporate hierarchies, ultimate beneficial ownership, alternative-type relationships, historical ownership, and analytically derived connections. We continuously monitor the dynamic changes to these relationships, including corporate actions such as mergers, acquisitions and divestitures and make relevant updates.

Finance Solutions

D&B Receivables Intelligence powered by FIS GETPAID

D&B Receivables Intelligence powered by FIS GETPAID combines artificial intelligence, automation, and analytics from the Dun & Bradstreet Data Cloud to streamline your accounts receivable processes and help you get paid faster.

With D&B Receivables Intelligence, you can:

- Improve cash flow with risk-based collection strategies and campaigns powered by Dun & Bradstreet data and analytics

- Drive efficiency with AI and automation to streamline collections management processes and reduce administrative burden

- Empower your customers with a safe, secure self-service portal to lower operational costs and get paid faster

Unlike other platforms that require customization and long implementation schedules, D&B Receivables Intelligence is configurable and easy to implement. Companies can get up and running swiftly with dedicated implementation support.

D&B® Credit Intelligence

D&B® Credit Intelligence is a scalable platform that provides everything from comprehensive credit reports to end-to-end automation. Users can simply access credit reports that feature Dun & Bradstreet’s proprietary AI-driven credit scores and ratings, or easily implement automated decisioning and account reviews.

Make Confident Decisions with D&B Credit Intelligence

• MAKE CONFIDENT DECISIONS – Leverage the Data Cloud for informed risk assessments

• ENHANCE BUSINESS INSIGHT – Understand total potential risk with end-to-end visibility

• INCREASE EFFICIENCY – Automate credit decisioning and account reviews

Make confident credit decisions with Dun & Bradstreet’s unrivaled business insights and predictive analytics on more than 455 million companies in the Data Cloud. Company reports in D&B Credit Intelligence also feature timely third-party web and social information, such as the latest business headlines, social media posts, and management changes.

D&B Financial Analytics

D&B Finance Analytics is the complete AI-driven platform powered by the Dun & Bradstreet Data Cloud. Intelligent, flexible, and easy to use, D&B Finance Analytics helps finance teams to manage risk, increase operational efficiency, reduce cost, and improve the customer experience.

Third-Party Risk & Compliance Solutions

D&B Risk Analytics Supplier Intelligence

Confidently Manage Supplier Risk and Compliance Screening with Dun & Bradstreet

Introducing Dun & Bradstreet’s New Supplier Risk Management and Restricted Party Screening Solution

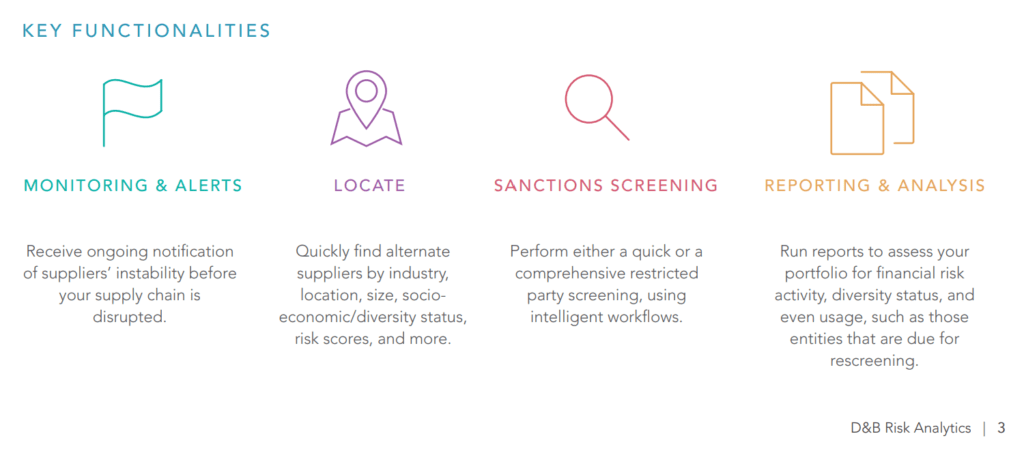

Anticipating and mitigating supplier risk just got even easier! D&B Risk Analytics is Dun & Bradstreet’s new supplier risk management and restricted party screening solution. Driven by AI-powered data and insights, the solution provides comprehensive third- party risk intelligence for a new era of focus on business resilience

Sales & Marketing Solutions

D&B® Salesforce Integration

Faster sales with instant decisioning in Salesforce®

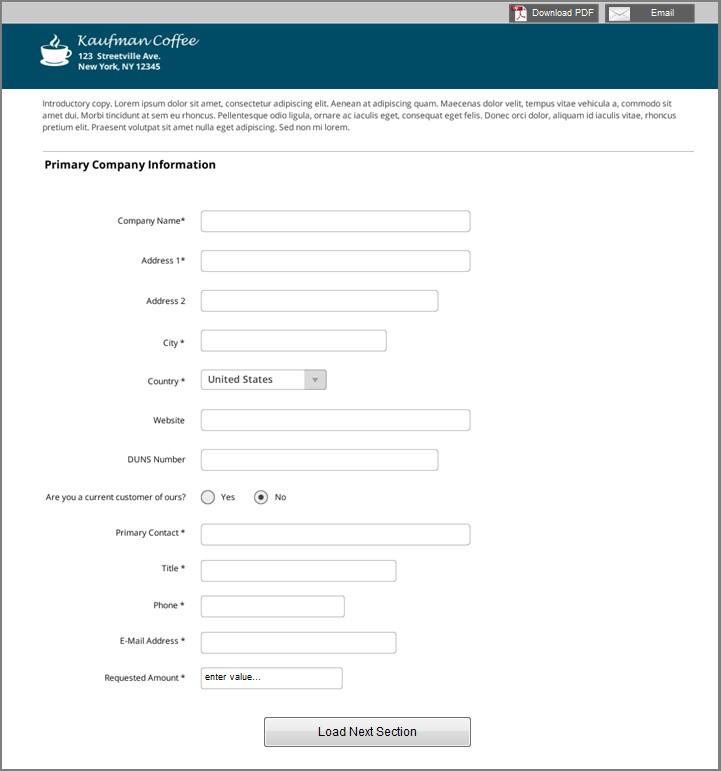

D&B® Credit Check for Salesforce links with D&B Decision Maker to create a powerful, automated end-to-end credit decisioning solution seamlessly integrating Dun & Bradstreet business data and your new customer review process with Salesforce™—to deliver credit judgments instantly.

How It Works

Long credit approval processes slow the sales cycle and “open the door” for competitors. D&B® Decision Maker and D&B® Credit Check for Saleforce delivers an automated, web-based end-to-end workflow that offers real-time point-of-sale credit decisioning—rendering accurate, consistent judgments on new applications instantly.

Reports & White Papers

Recession and Recovery: How Finance Can Prepare the Business for What’s Coming Next

Our new white paper explains how CFOs can, and should, shift their focus from keeping the business afloat back to helping it grow during the current transitional phase.

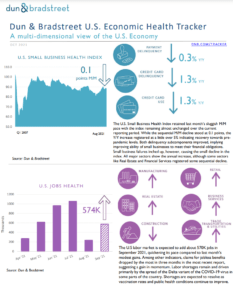

U.S. Economic Health Tracker

See our October 2021 report providing a multidimensional view of the health of the U.S. economy, focusing on small businesses, jobs, and overall levels of financial stress.

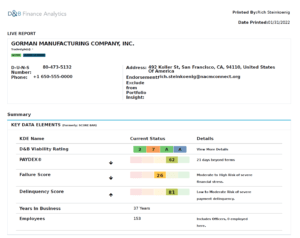

Comprehensive Credit Report

The D&B Viability Rating uses D&B’s proprietary analytics to compare the most predictive business risk indicators and deliver a highly reliable assessment of the probability that a company will go out of business, become dormant/inactive, or file for bankruptcy/insolvency within the next 12 months.

We Will Help You Every Step Of The Way

Credit Solutions Team

Rich Steinkoenig

Connecticut, Kansas, Michigan, Missouri, New Hampshire, Rhode Island

Gloria Scott

Chicago Area

Neil Cline

Northern & Western Illinois, Wisconsin, Nebraska

Jim Kelly

Indiana, Maine, South West Ohio (Cincinnati/Dayton areas), Vermont, Western Pennsylvania

Darren Greene

Massachusetts, New York, Ohio: Eastern, Northern and Central areas,that helps us to make credit decisions in a timely manner."

The return rate on my inquiries is about 99%. The success rate in accessing reports is extremely high when ordering Equifax Canadian Reports.“