We help you

Welcome to NACM Connect. We are a trade association for commercial credit professionals. Virtually every business transaction that concerns another business involves credit, so NACM Connect provides services and information to assist its members in all facets of their work activities. The association offers credit groups, credit reports, credit references, credit application processing, collections services, credit law information and more. In addition, NACM Connect provides education opportunities in credit, collections and related matters. Working toward the continuing professionalization of the credit management field is a continual high priority process. NACM Connect is an Affiliate of the National Association of Credit Management.

FALL CREDIT CONFERENCES

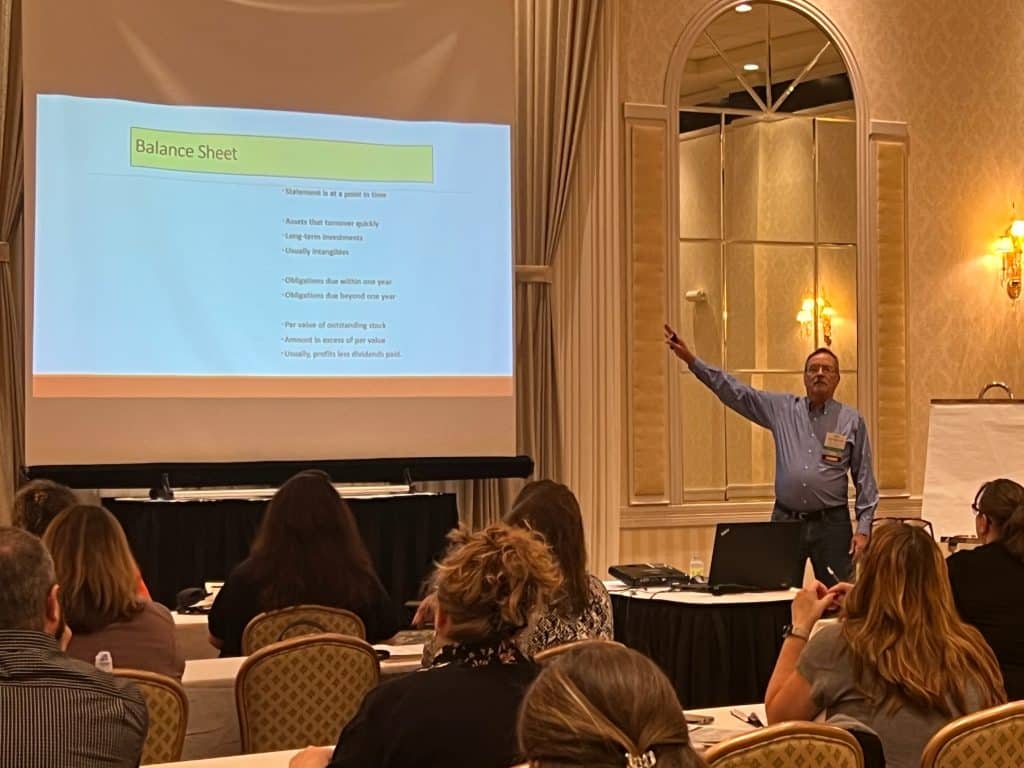

Get ready for an exciting experience at the NACM Connect Fall Credit Conference, where we’re diving into the engaging theme of “Undercover Credit!” Step out of the shadows and reconnect with fellow credit professionals in a lively atmosphere. Building upon the success of The Credit Tour 2025, our Spring regional meetings, we’re bringing the energy to life with two informative days filled with enriching education, dynamic networking, and a sneak peek at the latest innovations from our partners. Discover new insights and strategies that will elevate your career—don’t miss this opportunity!

WHY YOU SHOULD ATTEND

In a rapidly changing credit landscape, staying ahead is essential! The NACM Connect Fall Credit Conference is your secret weapon to navigate the latest developments in laws and technologies reshaping our industry. Join us for an insightful experience where you’ll earn Continuing Education Units/Credits and certification points while gaining essential knowledge. This is your opportunity to unlock new clues, connect with industry leaders, and uncover the tools that will propel your career forward. Embrace the excitement—your undercover mission awaits!

YOUR REGISTRATION INCLUDES:

- General sessions

- Continental breakfasts and buffet lunches

- Networking receptions

- Exhibit hall entry and contests

- Morning and afternoon breaks and refreshments

- One or Two full days of concurrent educational sessions

Download each event’s meeting attendee guide for full details. Visit our Conferences pages for more updates as we get closer to the events.

Featured Program

Grab a Cup & Join Us

Come and be a part of something exciting! Coffee with Connect allows you to meet with other members and participate in collaborative interactive discussions about subjects relevant to you as credit professionals. Coffee with Connect is a benefit of your membership with NACM Connect and will take place on Zoom as a monthly virtual event.

Previous Event Topics

- Arbitration, Mediation, Litigation, Oh My!

- Workplace Behaviors and Tools to Self-Manage, Engage, and Effectively Communicate with People at Work

- From Credit Applications to Bad Checks to Outright Stealing and Beyond, What Types of Fraud are You Seeing and How Are You Handling It?

- How NACM Connect Members Use Credit Reporting Services & Partnered Resources

- Personal Enrichment and Communication

- Hot Topics in Bankruptcies

- Portfolio and Credit Department Size

Other Programs

Highlighting some of the best programs for credit professionals:

Founded in 1973, the NACM Connect IOC (Institute of Credit) is the association’s education source set up to conduct formal education programs in the field of business credit management with a view to professional designations.

Industry Credit Groups

An Industry Credit Group supplies creditors with the most accurate and timely information available. All account receivable information is supplied by creditors currently doing business with your customers. Credit Group activities are monitored by NACM Connect to insure compliance with Federal anti-trust regulations.

Credit Report Services

NACM Connect covers all your commercial credit reporting needs. From domestic to international with access to Dun & Bradstreet, Experian, Equifax, Skyminder and the NACM National Trade Credit Report (exclusively for NACM members). Each reporting agency offers unique information to assist in making sound credit decisions, leading to reduced delinquency and fewer bad debts.

Careers In Credit offers services to help credit professionals and employers maximize their potential for success. Featuring industry-leading jobs that target both veteran and new credit managers, CIC is your premier job resource.