Seminars

NACM Connect offers a variety of topics through educational seminars throughout the year in half-day and full-day formats. Keep up with the latest developments affecting the credit community by participating in our educational programming. If you have any questions or suggestions for seminars topics please contact Bob Rabe at bob.rabe@nacmconnect.org.

Watch this page for new seminars or register for one of our upcoming events.

Virtual Seminars

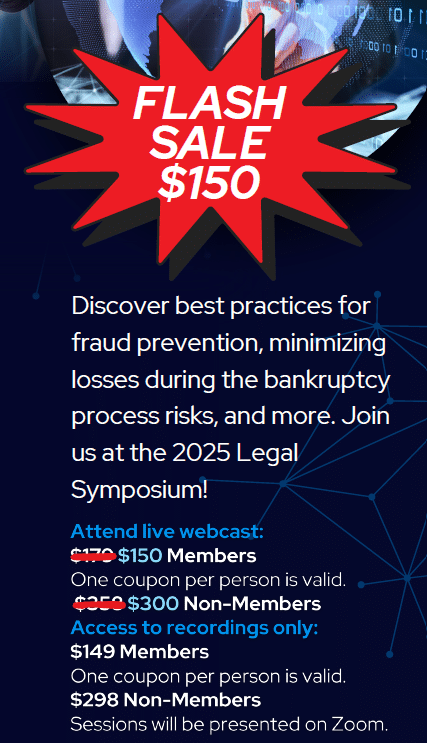

NACM Connect and the Commercial Law League of America are happy to announce the agenda for the 2026 Legal Symposium. The program will be 100% virtual this year, and the sessions will be recorded, so if you can’t attend during the live sessions, you will still be able to access the presentations from our esteemed speakers. Discover best practices for credit management, minimizing losses, electronic transactions, contracts, risk, and more.

SESSIONS AND DATES

All Sessions are one hour long and begin at 10 a.m. CT

Week 1 Session – March 05

Electronic Transactions in 2026: E-Signatures, Remote Notarization, and the New Legal Landscape: What Credit Executives Need to Know

Wanda Borges, Esq.

Borges & Associates, LLC

Session Description:

The legal framework governing electronic signatures and electronic transactions has evolved rapidly since 2020. While the federal ESIGN Act and the Uniform Electronic Transactions Act (UETA) remain the foundation of electronic‑signature legality, states continue to update and reinterpret their own statutes — including expanded adoption of remote online notarization (RON) laws and state‑specific electronic‑transaction acts. Recent judicial decisions have further clarified what constitutes a valid electronic signature, how consent to electronic contracting must be demonstrated, and the evidentiary standards courts apply when determining whether an electronic record is enforceable.

This updated program provides credit executives and compliance professionals with an understanding of the modern rules governing electronic transactions. Participants will learn how courts are currently evaluating electronic signatures, what technological and procedural safeguards companies must implement, and how to ensure that electronically executed credit applications, insertion orders, and commercial agreements are legally binding and defensible.

Biography:

WANDA BORGES, ESQ. is the principal member of Borges & Associates, LLC, a law firm based in Syosset, New York. For more than forty years, Ms. Borges has concentrated her practice on commercial litigation and creditors’ rights in bankruptcy matters, representing corporate clients and creditors’ committees throughout the United States in Chapter 11 proceedings, out of court settlements, commercial transactions and preference litigation. She is a member and Past President of the Commercial Law League of America and has been an Attorney Member of its National Board of Governors, a Chair of the Bankruptcy Section and Creditors’ Rights Section. She is an internationally recognized lecturer and author on various legal topics including Bankruptcy Issues such as 503(b)(9) claims and preferences, the Uniform Commercial Code, ECOA, FCRA, antitrust law, and current legal issues such as Credit Card Surcharge issues, Social Media, Cybersecurity and Ethics for the Trade Credit Grantor and current proposed legislation that may impact trade credit grantors. Ms. Borges has authored, edited and continues to contribute to numerous publications.

Week 2 Session – March 12

What’s In Your Contract?: The Three Biggest Contractual Pitfalls

Tim Wan, Esq.

Smith Carroad Wan & Parikh

Session Description:

Where do you sue? Do you have an exclusive jurisdiction clause in your agreement?

When does arbitration work? What’s the real-life difference in costs and time between arbitration and litigation? Are you adding interest or late fees? What is legal, recommended, or could lose you the business? Come speak with Timothy Wan, Esq., and hear his sometimes unpopular, but always passionately reasoned answers to the above questions!

Biography:

TIMOTHY WAN, ESQ. is Senior Partner and the Chief Executive Officer (CEO) of Smith Carroad Wan & Parikh, a division of the Wan Law Group, located on Long Island, New York. Mr. Wan’s areas of expertise include managing the creditor’s rights and collection law practice, serving as General Counsel to various small businesses in the local business community, and spearheading practice in the area of entertainment law, music law, copyright, and intellectual property.

Mr. Wan was admitted to the New York State Bar in January 2001, after graduating from Brooklyn Law School for his Juris Doctor where he was a member of the Moot Court Honor Society, and from Vassar College with a double B.A. in Political Science and Theatre in 1997.

Mr. Wan is a Past Chair of the Eastern Region of the Commercial Law League of America, a Past Chair of the CLLA Young Member’s Section, past member of the Board of Governors, and served as the first ever two-consecutive-term President from 2019-2021. He also serves as the President of the New York State Creditors Bar Association. Mr. Wan is a two-time Past President of the Infinite Exchange Chapter of BNI, and his firm is a member of the International Association of Commercial Collectors. Mr. Wan is a published author of the New York chapter of the textbook, “Judgment Enforcement” published by Aspen Publishing, and is a featured columnist and on the Board of Associate Editors for “Commercial Law World”. He is also the attorney advisor to the Commack High School Mock Trial team, and regularly lectures on topics regarding creditor’s rights, collection law, business change management, improving business efficiency, and legal strategy.

Week 3 Session – March 19

Forensic Files – Credit Professionals’ Edition Case Studies for Catching and Evading Dangerous Customers

Bruce Nathan, Michael Papandrea,

Andrew Behlmann

Lowenstein Sandler, LLP

Session Description:

2025 saw financial distress and restructuring activity continue at a frenzied pace, with both out-of-court refinancing transactions and chapter 11 filings exploding. By the end of the year, commercial chapter 11 filings in 2025 outpaced every year since 2010, the tail end of the global financial crisis. None of these filings should have surprised astute credit professionals who were paying attention. This program helps credit professionals think like investigators, using case studies of three companies that filed bankruptcy in 2025: Ascend Performance Materials, Klockner Pentaplast, and First Brands Group. The speakers will dissect the factors that led to each bankruptcy filing, then review clues that were readily visible long before the subject companies ever set foot in a bankruptcy court. The speakers will also discuss the unique characteristics of First Brands Group as a fraud case. Using the clues gleaned from the case studies, the presenters will help credit professionals build rapid response playbooks—tightening terms, securing assurances, deploying UCC tools, and dealing with potential preference liability—to help pivot from detection to protection with confidence and control.

Biographies:

ANDREW BEHLMANN

Partner

Bankruptcy & Restructuring Department

Andrew Behlmann leverages his background in corporate finance and management to approach restructuring problems, both in and out of court, from a practical, results-oriented perspective. With a focus on building consensus among multiple parties that have competing priorities, Andrew is equally at home both in and out of the courtroom, and he has a track record of turning financial distress into positive business outcomes. Clients value his counsel in complex Chapter 11 cases, where he represents debtors, creditors’ committees, purchasers, and investors. Andrew writes and speaks frequently about bankruptcy matters and financial issues.

BRUCE S. NATHAN

Partner

Bankruptcy & Restructuring Department

With nearly 45 years of experience in the bankruptcy and insolvency space, Bruce Nathan is a recognized leader in trade creditor rights and the representation of trade creditors in bankruptcy and other legal matters. He has represented trade and other unsecured creditors, unsecured creditors’ committees, secured creditors, and other interested parties in many of the larger Chapter 11 cases that have been filed. Bruce also handles letters of credit, guarantees, security, consignment, bailment, tolling, precious metals leases, and other agreements with financially distressed counterparties, as well as other credit-related legal issues for institutional clients. Bruce’s experience spans a broad range of industries, including agriculture, food and beverage, paper, publishing, media, floor covering, furniture, chemicals, manufacturing, and precious metals.

MICHAEL PAPANDREA

Counsel

Bankruptcy & Restructuring Department

Michael Papandrea provides counsel to debtors, creditors’ committees, individual creditors, liquidating trustees, and other interested parties with respect to corporate bankruptcy and creditors’ rights matters, including bankruptcy-related litigation. Reliable and efficient, Mike is appreciated for his innate ability to effectively apply and convey his understanding of the law and general business principles with respect to complex issues, both while providing advice to clients and while aggressively advocating on their behalf. Mike works tirelessly to understand clients’ needs and provide practical solutions that are reasonable, balanced, and favorable to the clients he serves.

Week 4 Session – March 26

Best Practices in Credit Management

Kirk Burkley, Shawn McClure

WH Burkley, LLP

Session Description:

Learn best practices in credit management and how to effectively evaluate customers, manage risk, and respond when collection issues arise. Extending credit always carries risk, but clear policies, proper procedures, and informed decision-making can significantly reduce potential losses. Understanding how credit decisions impact profitability, when to extend credit and when to walk away, and how to properly manage collections are key to protecting your company’s interests.

Assessing Potential Customers

- Establishing clear policies and procedures for extending credit

- Understanding how your company makes money (and loses it)

- Utilizing the Credit Application

- Credit limits and/or sign off levels

- Knowing when to walk away from a potential customer

- The Get P.A.I.D. system

Understanding and Addressing Various Risks

- Identifying relevant nonfinancial risks (Potential Future Crises)

- Proper use of social media and other technology

- Battle of the forms

- Use of invoices, terms, and conditions

Collections

- Procedures and policies for collections

- Internal collections within the company

- Third party collections

- Pre-Bankruptcy planning

- Bankruptcy techniques

- The Legal Process

- Reliable records and documentation

- Proper witness support

Biographies:

Kirk B. Burkley, Esq.

- Managing partner of WH Burkley, LLP (formerly known as Bernstein-Burkley, P.C.)

- Practice emphasizes all aspects of bankruptcy and restructuring, creditors’ rights, business and corporate transactions, litigation, real estate, and oil and gas

- Conducts regular seminars/live webinars and workshops on bankruptcy, creditors’ rights, and oil and gas

- Author of several publications related to the bankruptcy field, with work appearing in ABI Journal, Equipment Leasing Newsletter, Pennsylvania Association of Credit Managers Newsletter The Creditor, and more

- Currently serves as Chair of the Bankruptcy Section Executive Council of the Commercial Law League of America (CLLA) and is an emeritus board member of the American Board of Certification, where he previously served as President in 2020

- J.D. degree, University of Pittsburgh School of Law; B.S. degree, Ohio University

- Can be contacted at kburkley@bernsteinlaw.com or 412-456-8108

Shawn P. McClure, Esq.

- Partner at WH Burkley, LLP (formerly known as Bernstein-Burkley, P.C.)

- Practice oversees collection efforts, foreclosure and mechanics’ liens, replevin actions, bond litigation, and a broad spectrum of credit-related matters

- Admitted in Pennsylvania (2007), Ohio and West Virginia (2014), and key federal districts, he brings multi-state credibility and cross-jurisdictional expertise

- Speaks at CLEs for NACM, Lorman Educational Services and NBI

- Saint Francis University – B.S. Accounting – 2003

- Duquesne University School of Law – Juris Doctorate – 2007

- Contact information: smcclure@bernsteinlaw.com or (412) 456-8117

In-Person Seminars

Collection Tips & Tricks

10:30 am – 11:30 am ET

- Risk Reduction

- Internal Collections

- Collecting Past Due Accounts

- Handling Excuses

- When to write off/send to collections

- Referring to an attorney

Legal Options for Dealing with Delinquent Customers

12:00 pm – 2:00 pm ET

- The Legal Option Matrix

- Breach of Contract / Unjust Enrichment

- Fraud / Fraudulent Transfers

- Guaranty Enforcement

- Jurisdiction

- Discovery

- Involuntary Bankruptcy

All registrations for NACM Connect education events are taken online at www.nacmconnect.org. While registering online, you will have the opportunity to choose your payment method. We are happy to take a credit card online or invoice you. You will also have the opportunity to apply coupons as allowed. All payments must be received one week prior to seminar date.

Cancellation Policy: Cancellations must be received in writing via email or mail, no later than one week prior to meeting date to qualify for full refund. Cancellations received later than one week prior to the meeting date DO NOT qualify for a refund of registration fees. Sorry, phone cancellations cannot be honored. If you have any questions, please email info@nacmconnect.org.